Buying guide

Is it cheaper to rent or buy a house?

Let’s do the maths

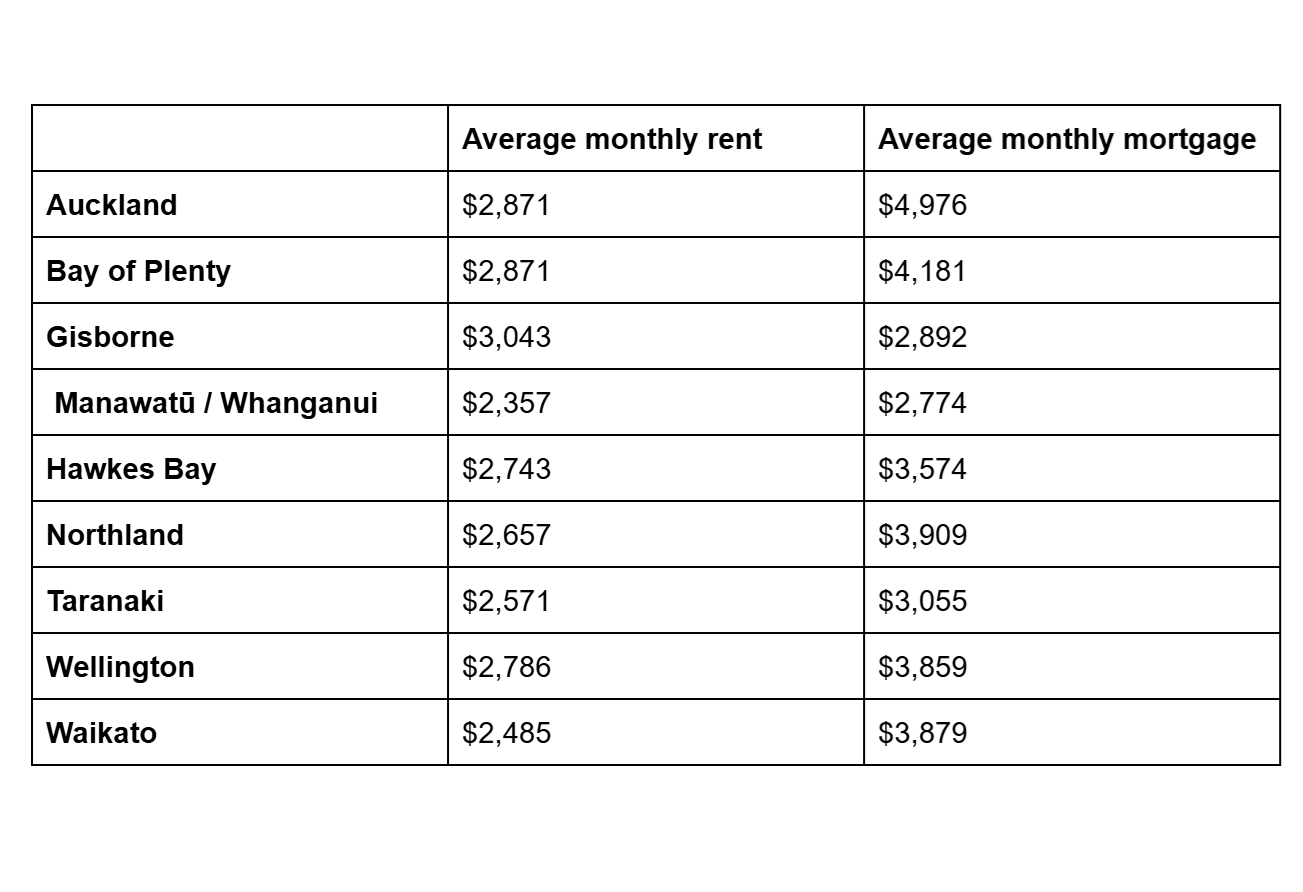

Rent vs. mortgage costs in New Zealand’s North Island

All statistics are from Trade Me Property's rental price and property price indexes (12/2024)

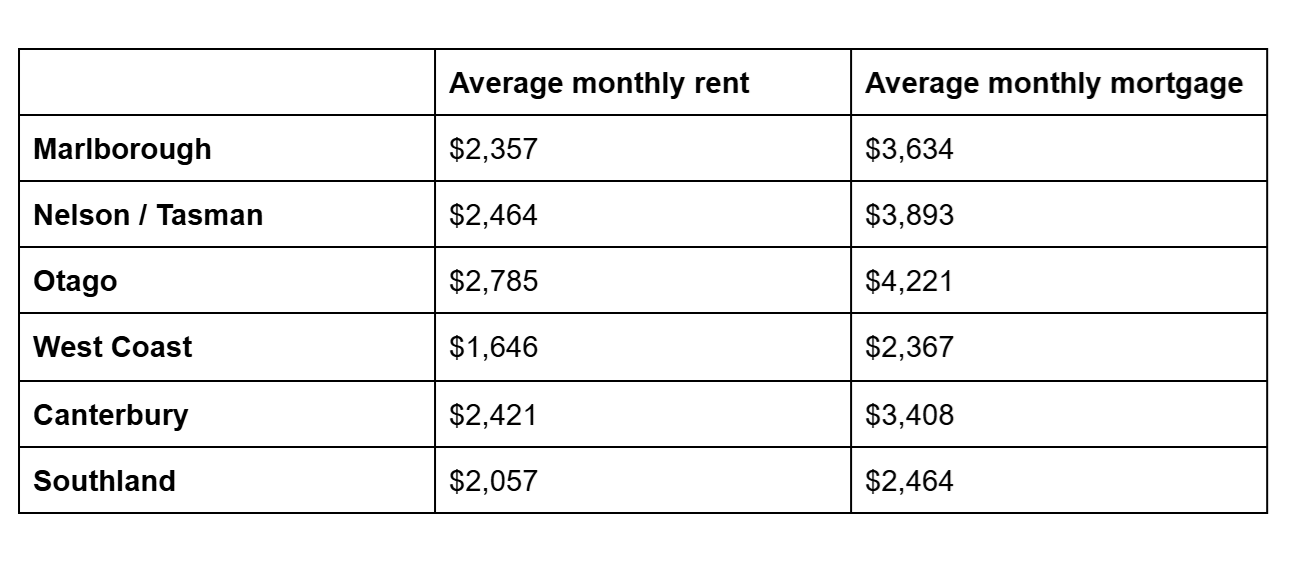

Rent vs. mortgage costs in New Zealand’s South Island

All statistics are from Trade Me Property's rental price and property price indexes (12/2024)

Owning a house is generally more expensive than renting

How did we work it all out?

Buying is more expensive but it can be the better long term option.

Exceptions to the rule

The impacts of having a larger home deposit

You’re purchasing a very affordable house

Interest rates are lower than they currently are (12/2024)

You’re participating in a rent to buy scheme

Buying isn't always the best idea - it depends on your lifestyle, goals and financial circumstances.

It’s more expensive, so why buy?

Author

Discover More

Search

Other articles you might like