Feature article

Kiwi remain confident about buying houses despite slowing market, bank survey says

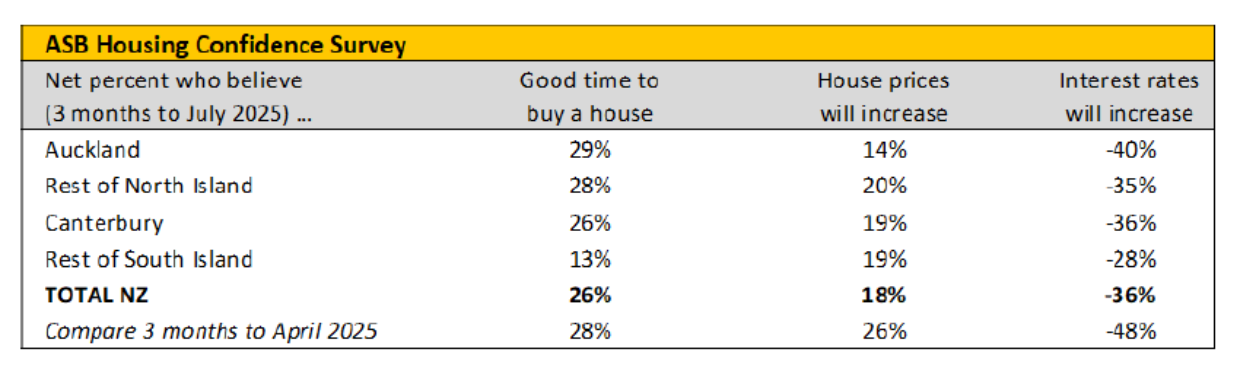

New Housing Confidence Survey, shows 26% of Kiwi think now is a good time to buy a home.

FAST FACTS

ASB housing confidence survey findings

Kiwi are staying surprisingly upbeat about buying homes, even though the housing market has seemingly cooled down.

Author

Search

Other articles you might like