Buying guide

Mortgage holidays: Can I take one and what will it cost me?

In some cases you may be able to take a break from mortgage repayments. Here’s everything you need to know.

What is a mortgage holiday?

Applying for a mortgage holiday in NZ: Two steps

A mortgage holiday will increase the overall cost of your loan

Everybody needs a break every now and then.

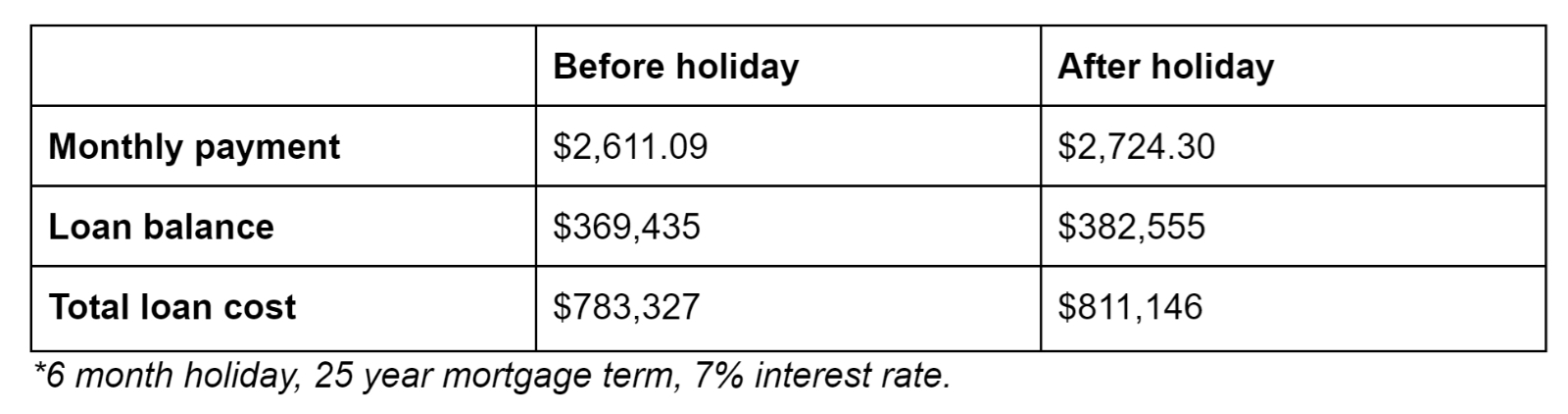

How much more could a mortgage holiday cost me?

Example of mortgage holiday extra costs

Alternatives to a mortgage holiday

Reducing your mortgage repayments to a manageable level

Making interest only payments

Extend your loan term temporarily

Consolidate high interest loans

Refinance and get cash back

When something unexpected happens there is help available to make sure you can keep your home.

Making a plan for when your mortgage holiday ends

Get free financial advice

Author

Discover More

Property value NZ: Check your house value online

Get a better understanding of property value across New Zealand

‘It’s time for life and laughter to fill the bach again’: Architect’s retreat and boatshed listed 30 years on

This two-level bach at Maraetai Bay in Queen Charlotte Sound was designed by the late architect Jonty Rout.

Search

Other articles you might like