Buying guide

NZ interest rate predictions 2026

Make informed decisions

After peaking in mid 2024 interest rates trended downward throughout 2025, to the great relief of many mortgage holders. But what’s next?

To help you make informed decisions around your home loan we’ve gathered interest rate predictions from the country’s leading experts for 2026 and beyond.

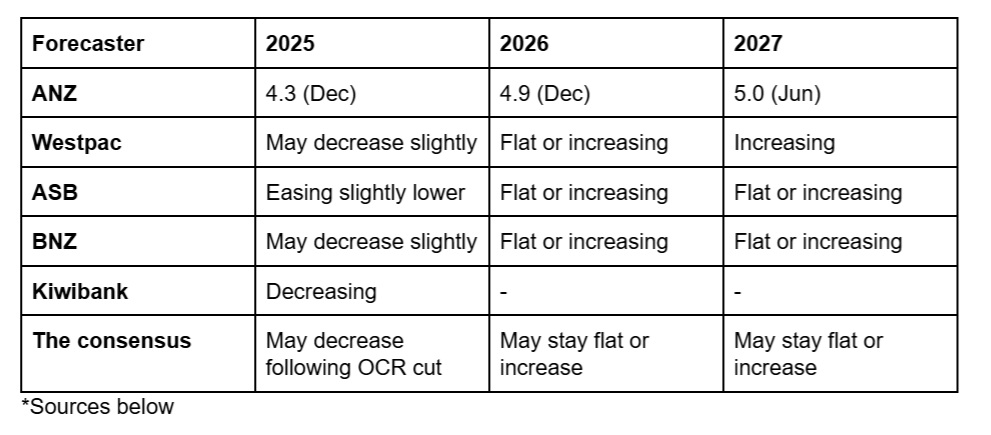

NZ mortgage interest rate forecasts (1 year fixed)*

Our summary of interest rate predictions from the experts

There’s a consensus amongst forecasters - that we may be at the bottom of the interest rate cycle, with most one year rates in the mid-low 4s.

Forecasters expect six month and one year rates may drop a little more in early 2026 following the November OCR cut, before plateauing or gradually increasing throughout 2026 and 2027.

Longer term rates like 2, 3 and 5 years may already be at their lowest points. These may start to increase soon.

Keep in mind that these forecasts are based on current information. The global and domestic economies are facing a number of headwinds that could change things at any moment.

ANZ

ANZ Bank forecasts mortgage rates are nearing their bottom, and will be at their lowest point in late 2025 or early 2026. At this stage one year rates will be 4.3%, two years 4.4%, three years 4.6%, five years 5.1%. From there ANZ sees rates trending slowly upward, with one year rates reaching 4.9 % by December 2026. Here’s the advice they provided in their October Property Focus:

“[projections point to] Further moderate falls, and with rises unlikely, borrowers likely have a little more time – months, not quarters – before needing to make a decision. However, we would warn that the window could close rapidly if economic data starts to improve. We thus think it

makes sense to make a plan to extend duration over coming months, and to consider spreading risk over a number of terms.”

“The 2-year term is of obvious value given how low it is compared to other terms, but 3 years may also be worth considering, given that we expect the OCR to start rising from early 2027.”

Westpac

Westpac holds a similar view to ANZ, stating in a October weekly commentary paper that they expect the cash rate to bottom out at 2.50% in December 2025. The bank’s economists say that short term mortgage rates (6 months, 1 year) may fall slightly further, but fixing long term is a good option given the expected 0.25 OCR cut has come to fruition:

“Very short-term mortgage rates will likely fall slightly if the RBNZ cuts the OCR as we expect, but they remain above current longer-term fixed rates. At current rates, fixing for longer periods of two to three years looks attractive.”

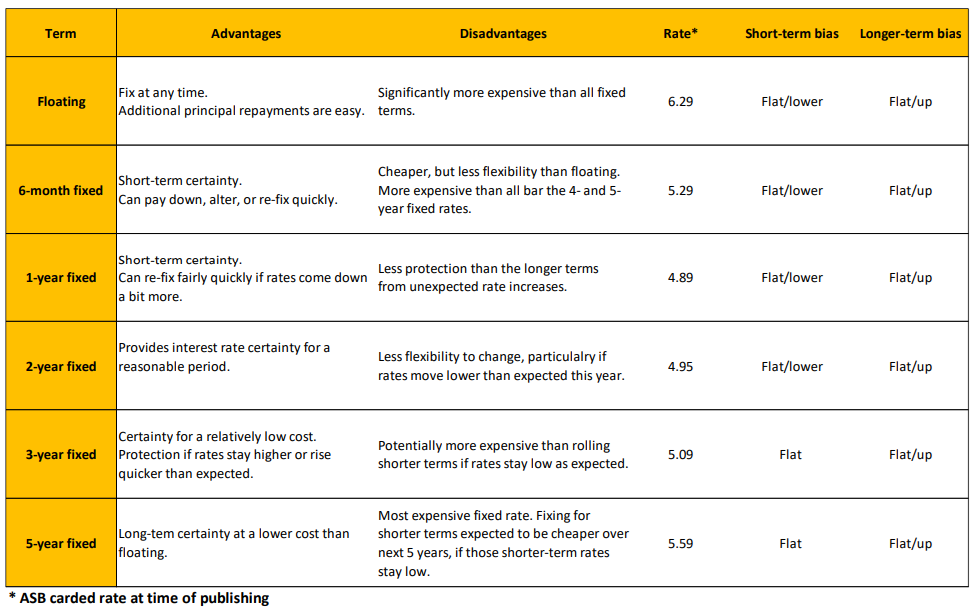

ASB

ASB bank’s economists bias for rates of 2-year, 1-year, and 6 months is that they may be flat or decrease slightly in the short term, then remain flat or increase in the long term. They believe rates of 3 years and longer will remain flat, then possibly increase long term. Their tabled advice from a 27 August Home Loan Report below lays out the pros and cons of fixing for each period:

Interest rates are tipped by most to decrease throughout 2025.

BNZ

BNZ aren’t making many concrete retail interest rate predictions in recent reports, but in their October Economy Watch paper they provided some indications of where they believe rates are headed in line with the OCR. They warned that we could have reached the bottom of the interest rate cycle, with rates to plateau or increase in 2026 and beyond:

"The hurdle to further action does look sigificant, with the door for further easing barely open. To the point that the main message appears to be that it is highly likely the easing cycle is done."

Kiwibank

Kiwibank is forecasting a 50% chance of one more OCR cut following the November reduction. As for where they think interest rates are headed, the title of their recent commentary says it all:

"Are we there yet? We're very close. This could be the low in interest rates"

Assuming Kiwibank are correct, it may be wise to fix short term then refix for a longer term now or in February once the OCR has reached its forecasted lowest point (that said, forecasts should always be taken with a grain of salt and Kiwibank could of course be wrong).

A note about advertised interest rates*

Lender’s advertised rates are often higher than the actual rates they provide many customers. Speak to a mortgage broker to ensure that you get the best available rate from your lender.

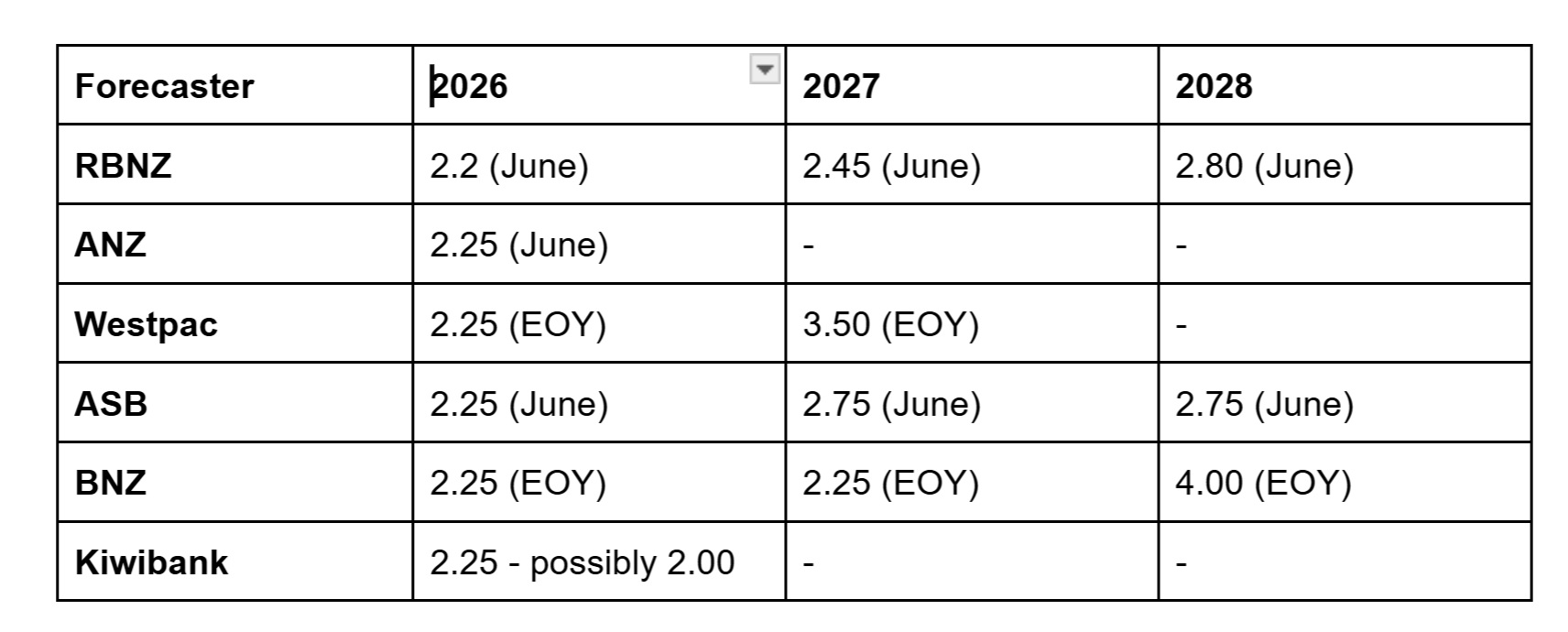

Official cash rate predictions 2025 and 2026

When predicting interest rates in NZ it’s helpful to also look at the OCR, as this number obviously affects rates offered by banks. Here’s what the experts are saying:

Sources: Bank reports

Our summary of OCR forecasts

The general consensus amongst bank forecasters is that the OCR is at its lowest following a November cut to 2.25%. Most economists agree there is some chance of one more cut, depending on inflation and economic data - Kiwibank is most optimistic of all, saying there's a 50% chance.

According to the Reserve Bank, around 0.80% (percentage points) of an initial 1% change in the OCR is typically passed through in higher or lower mortgage rates six months afterwards. If that’s true, if we get a 0.25% cut in February we can expect short term rates to decrease by around 0.2%.

Based on these assumptions, we can expect a one year rate of around to 4.3% if the OCR is not cut again, and 4.1% if it is.

The million dollar question: How long should I fix my mortgage?

Unfortunately, nobody can tell you how to manage your mortgage. What’s most important is that you get advice from an advisor you can trust, and structure your loan in a way that suits you and helps you reach your goals (more on getting advice later).

With that disclaimer out of the way, here’s what the experts are saying:

Opes Partners say the 1 year rate is a great option

Ed Mcknight the Head Economist at Opes Partners has a simple strategy if you’re going for the lowest possible rate: “My personal go-to mortgage strategy is to fix my mortgages for the 1-year rate no matter what. Previously, this has led to a low average interest rate.”

According to Opes, this would have resulted in the lowest interest rate of any term over the last twenty years.

Gareth Kiernan at Infometrics argues for shorter term fixes *with a caveat

Infometrics chief forecaster, Gareth Kiernan, conducted analysis of which rates were most cost effective, and found that shorter term rates generally won out. He told RNZ:

"It's really difficult to pick, but shorter fixed terms will generally be more cost-effective. The time you should consider longer terms is when they've just started pushing upwards - even if they're the highest rates compared to shorter terms on offer at the time."

The last sentence is an interesting one, given longer term rates may have just started increasing in the last several months.

New Zealand's biggest bank says interest rates are headed downard.

Tony Alexander reckons the three year is the rate

Economist Tony Alexander says that due to economic uncertainty around the US economy, and the potential that our monetary policy easing cycle is at its end, it’s hard to make any concrete predictions about where rates are headed. That said, he does prefer the three year fix:

“If I were borrowing at the moment, I’d personally opt for fixing three years ....”

Nicole Pervan, GM of home lending at Kiwibank says it’s all about you

Frances Cook wrote a brilliant article in May covering seven mortgage tips. One of the best tips was from Nicole Pervan, GM of home lending at Kiwibank, who recommended thinking about what you’re expecting to happen in your life in the next 1-5 years before fixing:

“If you’re about to go on parental leave, or you're thinking of selling in the next year, that should affect your choice between fixed or floating,” she says.

“Certainty can be just as valuable as a sharp rate, especially when you’re budgeting with tight margins.

Jarrod Kerr, Chief Economist at Kiwibank, recommends splitting:

By splitting your mortgage into different, staggered fixed term durations you gain extra security and flexibility. The idea is that your fixed terms don’t all expire at the same time and your costs don’t suddenly increase – at the same time you can still benefit from falling rates.

"Consider a mix of fixed-term durations including 6 months, 1 year, 2 years and 5 years," he says.

This strategy means you will never get the lowest rate that you might have if you’d timed the market, but it also reduces the risk of paying a much higher rate than you need to.

Consider break even analysis

Break even analysis is a way to help decide which interest rate is likely to be the better deal in future. It’s a tricky concept to explain so let’s look at an example:

You’re considering whether to fix for one year at 5.99% or two years at 5.69%.

The total interest charge for a two year rate would be 5.69 x 2 = 11.38% total.

That means if we fix for one year at 5.99% and then refix a year later at anything under 5.39% the one year rate is a better deal (Here’s how we worked that out – two year total interest cost 11.38% - one year interest cost 5.99% = 5.39%).

The above calculation isn’t 100% accurate because of compounding interest, but it’s close.

It tells us that if we think one year interest rates will fall below 5.39% in a year, we should go for one year to minimise the interest we pay. If we think they’ll be above that number, two year is a better deal.

These calculations are, of course, hypothetical because we don’t have a crystal ball, but they can be a useful way to make decisions based on what we think is likely to happen.

The Reserve Bank plays a big part in influencing retail interest rates.

Get expert advice first

It can be interesting to predict the future and guess where interest rates are headed, but all predictions should be taken with a grain of salt. Economists have been wrong in the past, and they’ll be wrong in the future.

The fact is, no one can predict the global and domestic events that affect our economy and interest rates with any certainty. Something unexpected could happen tomorrow that makes all of the above forecasts entirely wrong.

The most important thing is to get advice to make sure that your mortgage is tailored to suit your financial circumstances, your appetite for risk and your goals. For help making sure your home loan is right for you, we recommend speaking to an experienced financial advisor or mortgage broker before you buy your first home, and regularly afterwards to review your loans and financial position. That way, if the economists are wrong you’ll be in a strong position to weather whatever storm comes your way.

Author

Discover More

Tasman temptations in hot spots like Kaiteriteri and Ruby Bay

Who wouldn’t want a house close to Abel Tasman National Park and at beaches like Kaiteriteri, Ruby Bay, and Mapua?

Riverside log cabin on site of legendary Kiwi music festival hits the market

The Douglas Fir log cabin in Waihi can sleep 12.

Search

Other articles you might like