Buying guide

OCR predictions NZ 2024/2025

What’s Mr Orr’s next move?

Last updated: 5 June 2024

Throughout 2023 and 2024, the official cash rate (OCR) has remained at its highest level since the global financial crisis.

But what do the expert’s NZ OCR predictions tell us about the future? To keep you in the loop, we’ve rounded up opinions and forecasts from those in the know.

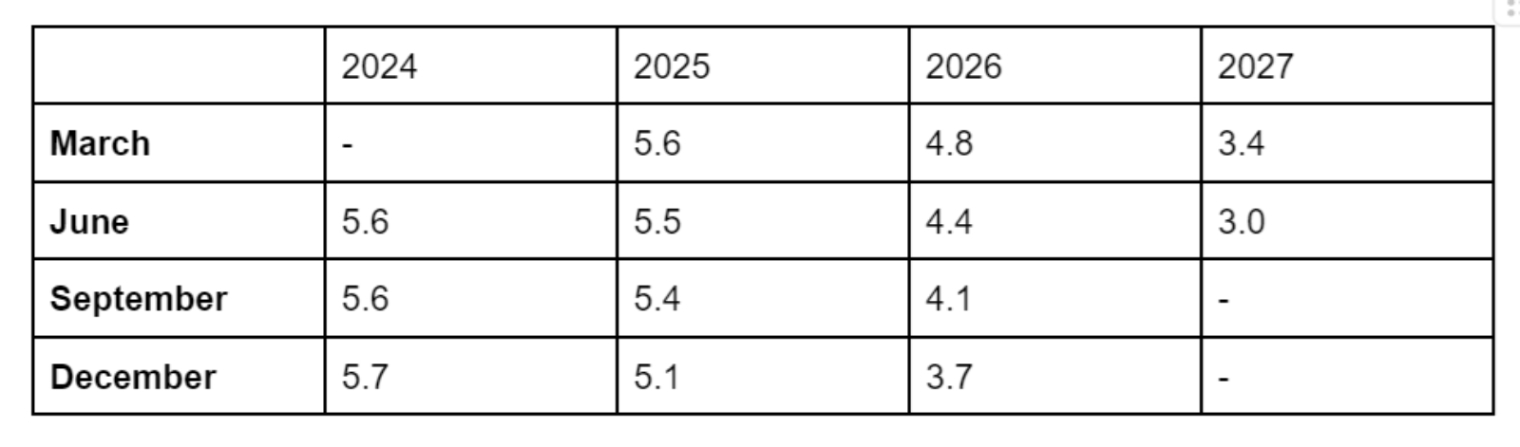

Reserve Bank OCR predictions NZ

*Source: Reserve Bank of New Zealand.

The Reserve Bank’s most recent OCR review on 22 May 2024 didn’t look good for borrowers. They agreed to keep the cash rate at 5.5% and indicated that it would need to remain high for a sustained period to restrict inflation - possibly until mid or even 2025.

The statement indicated that there was a small chance of a cash rate increase in 2024 by forecasting an OCR peak of 5.7% in December 2024. The committee also predicted that the OCR would still be at 5.5% in June 2025, before decreasing to 5.1% by December 2025 and 3.7% by the end of 2026.

OCR forecasts from economists

Following the Reserve Bank’s May Monetary Policy Statement, a number of economists shared their views on where the OCR and interest rates are headed in future:

Jarrod Kerr, Chief Economist at Kiwibank expects the Reserve Bank to start cutting the OCR in either November 2024, February 2025 or May 2025.

Nick Tuffley, ASB Chief Economist, said in a May update that the bank expects the Reserve Bank will wait until early 2025 to begin cutting.

CoreLogic NZ chief property economist Kelvin Davidson told the Herald that OCR and mortgage rate cuts were most likely a story for 2025, not 2024.

Unfortunately, inflation has remained more persistent than expected, and the Reserve Bank will need to keep the OCR high until it is under control (between 1-3%). This indicates that any significant decreases in residential mortgage interest rates may not happen until mid to late 2025. This is particularly true for one year fixed, six month fixed and variable mortgage interest rates, which will not decrease until banks are sure OCR cuts are just around the corner, according to ASB senior economist Chris Tennent-Brown, in a comment to RNZ.

The OCR directly affects the disposable income of Kiwi homeowners.

How long should I fix my mortgage?

The OCR is expected to come down sometime between late 2024 and mid 2025, depending on how inflation tracks over the next 12 months. If those forecasts are accurate, mortgage interest rates should be lower in one year. Perhaps due to those expectations, many economists have indicated that fixing for one to eighteen months may be a good strategy right now.

With all that said, it’s always best to structure your mortgage in a way that suits your individual circumstances. If you value security and certainty, long term rates of two to three years might be the best option for you. If you’re willing to gamble on interest rates coming down soon, shorter term rates may be best.

Most importantly, before you make a decision, it’s always best to seek advice from a professional mortgage broker or financial advisor that you trust. They’ll provide insider advice on where interest rates are headed and help ensure your mortgage is built to help you reach your financial goals.

DISCLAIMER: The information contained in this article is general in nature. While facts have been checked, the article does not constitute a financial advice service. The article is only intended to provide education about the New Zealand OCR and mortgage sector. Nothing in this article constitutes a recommendation that any strategy, loan type or mortgage-related service is suitable for any specific person. We cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you. Before making financial decisions, we highly recommend you seek professional advice.

Author

Other articles you might like