Buying guide

Understanding leverage: a beginner’s guide

Don’t let jargon get in the way.

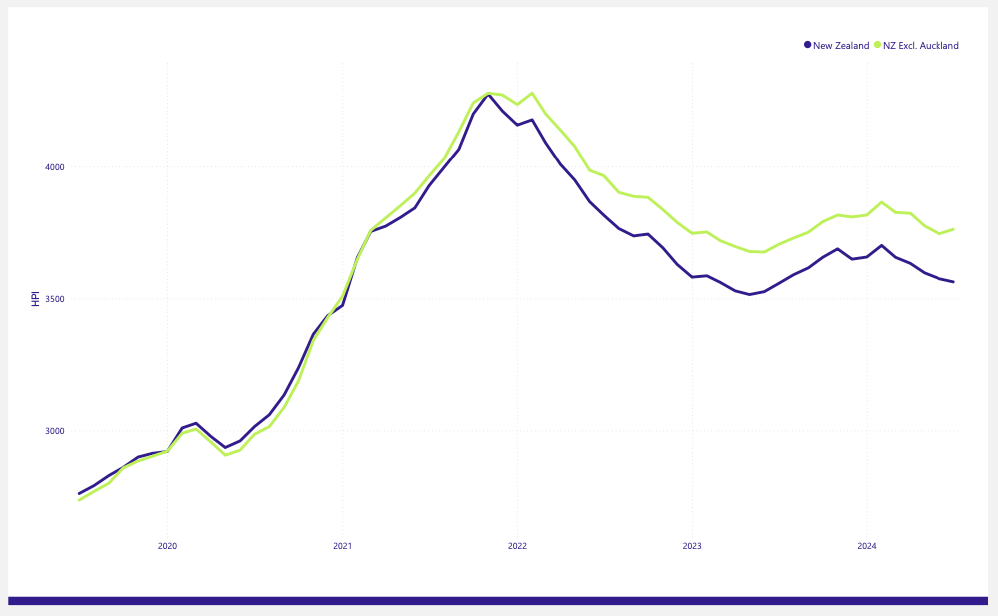

Image source: www.reinz.co.nz New Zealand House Price Index - June 2024

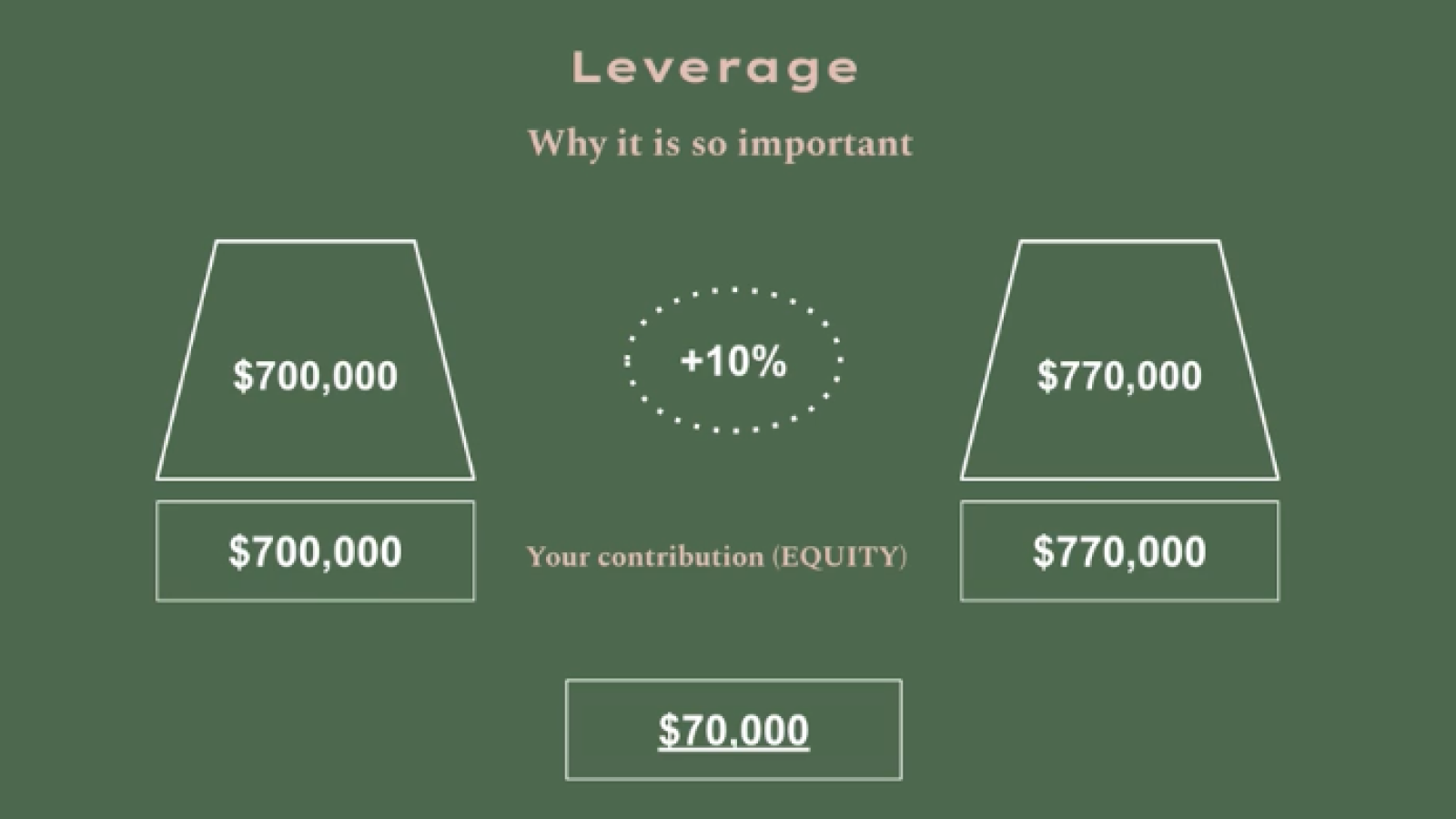

Example #1: No leverage

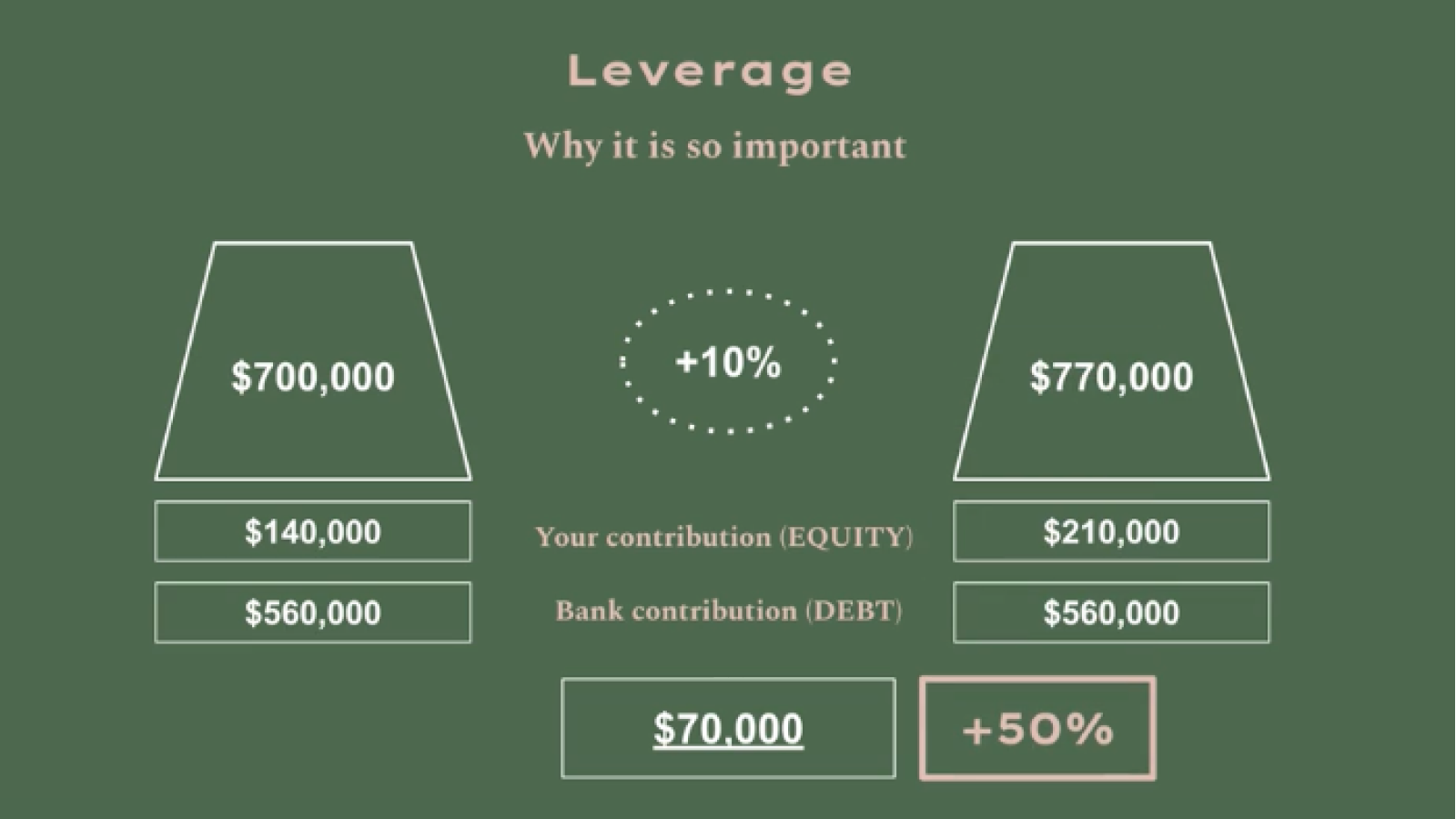

Example #2: With leverage + property prices RISE

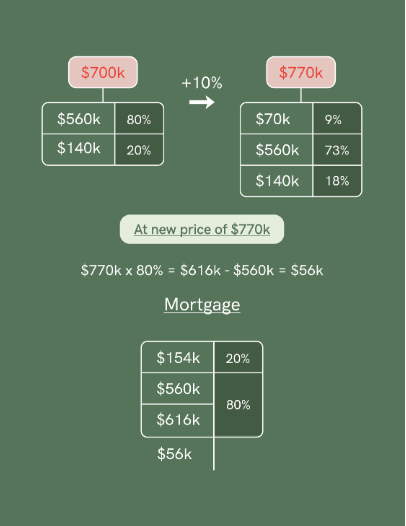

Example #3: With leverage + property prices FALL

Realised vs. unrealised leverage

The attractiveness of leverage

Financial Disclaimer

Author

Discover More

Search

Other articles you might like