News Next article

Property prices fall following spring peak

Property Pulse Report - November 2025

By Gavin Lloyd 11 December 2025The national average asking price has cooled after the spring market surge, dropping to $851,950 in November, according to the latest Trade Me Property Pulse Report.

The average asking price fell 3.5 per cent month-on-month but remains up 0.8 per cent year-on-year.

Trade Me Property Customer Director Gavin Lloyd said this drop is not unexpected as the market heads toward the end of the year.

"While the national average asking price is down around $30,000 on October it’s important to keep in mind the market is still trending upwards compared to a year ago.

“As a whole the market is showing a lot more stability than it has done in recent years.”

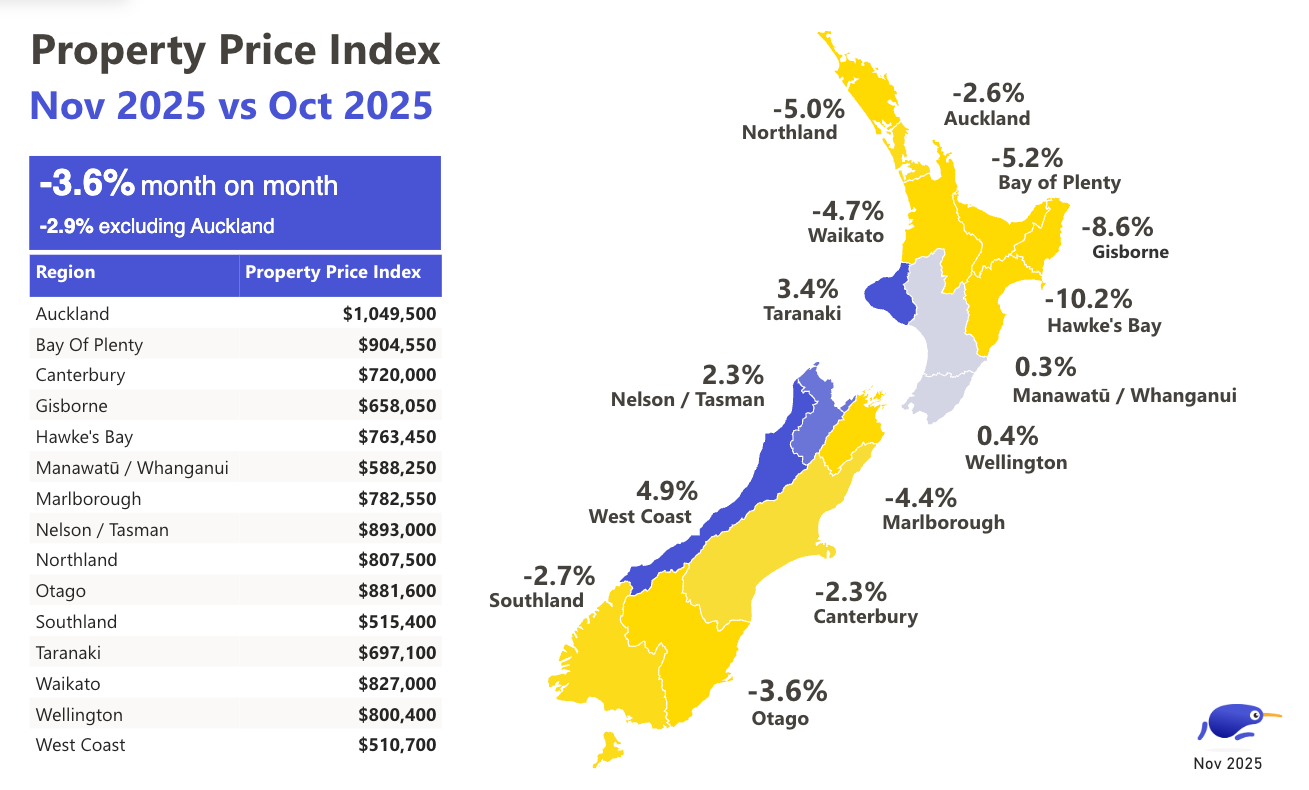

Regional highs, and lows

Most regions saw a month-on-month decrease in the average asking price in November, with Hawke's Bay and Gisborne recording the largest drops, down 10 and 9 per cent respectively.

“Gisborne is one to note, while it recorded one of the largest dips of the 15 regions we monitor compared to October, year-on-year it’s a big winner with the average asking price jumping more than 21 per cent to $658,050 in November.

“As a smaller market, Gisborne’s house prices can fluctuate more than a bigger city, however for eight of the past 11 months it’s recorded year-on-year increases, a fairly steady record.”

Manawatū/Whanganui (+0.3%) and Wellington (+0.4%) were flat month-to-month, while the West Coast, Nelson/Tasman and Taranaki were the only regions to show increases.

The average asking price on the West Coast is up 5 per cent to $510,700, Taranaki up over 3 per cent to $697,100 and Nelson/Tasman up more than 2 per cent to $893,000.

“Taranaki has also performed strongly on an annual basis, with prices up close to 6 per cent or around $38,000, likewise Otago which is up more than 4 per cent, buoyed by strong growth across Central Otago and Clutha in particular.”

Supply and demand

Both supply and demand saw a month-on-month decrease nationwide with new listings falling 13 per cent from October, and demand also down 5 per cent.

"The market is heading into the Christmas slowdown exactly as expected with both new listings, and demand easing compared to last month.

“That seasonal dip is predictable, but it shouldn't distract from the bigger picture. When we look at the year-on-year demand data the underlying demand remains very strong up 22 per cent. Our days onsite data also shows us properties are selling on average two days faster than November 2024.

“This tells us there isn't a lack of willing buyers, there's just a temporary lul as many around the motu prepare for the festive and holiday season.

“The moment the 'For Sale' signs go back up in the New Year, we anticipate some pent-up demand will return to the market, especially with improving affordability and falling interest rates acting as a tailwind."

| Region | Property Price Index | YoY % change | |||

|---|---|---|---|---|---|

| Auckland | Auckland | $1,049,500 | $1,049,500 | -0.6% | -0.6% |

| Bay of Plenty | Bay of Plenty | $904,550 | $904,550 | 1.2% | 1.2% |

| Canterbury | Canterbury | $720,000 | $720,000 | 0.5% | 0.5% |

| Gisborne | Gisborne | $658,050 | $658,050 | 21.2% | 21.2% |

| Hawke's Bay | Hawke's Bay | $763,450 | $763,450 | 2.3% | 2.3% |

| Manawatuū/Whanganui | Manawatuū/Whanganui | $588,250 | $588,250 | -2.2% | -2.2% |

| Marlborough | Marlborough | $782,550 | $782,550 | 3.2% | 3.2% |

| Nelson/Tasman | Nelson/Tasman | $893,000 | $893,000 | 3.8% | 3.8% |

| Northland | Northland | $807,500 | $807,500 | 1.5% | 1.5% |

| Otago | Otago | $881,600 | $881,600 | 4.3% | 4.3% |

| Southland | Southland | $515,400 | $515,400 | 0.1% | 0.1% |

| Taranaki | Taranaki | $697,100 | $697,100 | 5.8% | 5.8% |

| Waikato | Waikato | $827,000 | $827,000 | 1.3% | 1.3% |

| Wellington | Wellington | $800,400 | $800,400 | 0.0% | 0.0% |

| West Coast | West Coast | $510,700 | $510,700 | 11.8% | 11.8% |

Month-on-month change in the Property Price Index

Down -3.5% month on month

Explore Past Property Market Reports

Spring property market blooms as buyer demand surges, September 2025

House prices up for the first time in over a year, August 2025

Auckland house prices dip below million dollar mark, July 2025

Author

Other news you might like