The Ultimate Guide to Mortgages and Home Loans in New Zealand (2025 Edition)

Last updated: 16 April 2025

Navigating the mortgage landscape in New Zealand can be complex, especially for first-time buyers. This guide breaks down everything you need to know—from securing approval to managing your mortgage effectively.

What is a mortgage?

A mortgage is a type of loan specifically used to buy property. In simple terms, it’s an agreement between you and a lender—usually a bank—where they lend you the money to buy a home, and in return, you agree to pay it back over time with interest. The property itself acts as security for the loan, meaning if you can’t repay it, the lender has the right to sell the home to recover their money.

Most mortgages in New Zealand are paid off over 25–30 years through regular repayments, which cover both the original loan amount (called the principal) and the interest charged by the lender. The exact structure of your repayments depends on the type of loan you choose, your interest rate, and how much you borrow.

Getting Mortgage Approval

Pre-Approval: Your First Step

Before house hunting, obtaining a mortgage pre-approval is crucial. It provides an estimate of how much you can borrow, making you a more attractive buyer to sellers.

The Application Process

Lenders will assess your financial situation, including income, expenses, debts, and credit history.

Be prepared to provide:

- Proof of income (e.g., payslips)

- Proof of deposit

- Bank statements (3 months' worth)

- Identification documents

- Details of any existing debts

Understanding Deposits

What is a Deposit?

A deposit is the upfront amount you contribute toward the purchase of a home. It’s your share of the property’s value, while the rest is usually covered by a home loan (mortgage) from a lender. The deposit plays a big role in how much you can borrow and the terms of your mortgage.

The general rule in New Zealand is a 20% deposit, though there are lower deposit options available—especially for first-home buyers.

Standard Deposit Requirements

Typically, a 20% deposit is required for a home loan in New Zealand. For an $800,000 property, this equates to a deposit of $160,000.

Low Deposit Options

First-time buyers may be eligible for home loans with a deposit as low as 5% through government-backed schemes like the Kāinga Ora First Home Loan. These can be great options if you’re struggling to hit the 20% mark, but they may come with higher interest rates or stricter lending criteria.

Using KiwiSaver for Your Deposit

If you’ve been contributing to KiwiSaver for at least three years, you may be eligible to withdraw most of your savings to put towards your deposit. This includes your own contributions, employer contributions, and investment returns—but you'll need to leave a minimum balance of $1,000 in your account.

How Much Can You Borrow?

How much you can borrow depends on a combination of factors—your income, expenses, debts, deposit size, and credit history all play a part.

While lenders use a debt-to-income ratio to assess affordability, as a general rule, most New Zealand banks will lend up to five times your gross annual income for an owner-occupied home. So, if your household earns $120,000 a year before tax, you could potentially borrow around $600,000—assuming you meet the other lending criteria.

Mortgage Brokers vs. Banks

Mortgage Brokers

Brokers act as intermediaries between you and lenders, offering access to a range of loan products. They can:

- Provide personalised advice

- Negotiate better rates

- Assist with complex applications

Their services are typically free, as they're compensated by lenders.

Banks

Approaching banks directly offers:

- A straightforward application process

- Access to the bank's specific loan products

However, banks may not offer the same breadth of options as brokers.

Learn more about using a mortgage broker vs a bank.

OCR & Interest Rates

The Official Cash Rate (OCR) is a key tool used by the Reserve Bank of New Zealand (RBNZ) to help steer the country’s economy. It influences the cost of borrowing and the returns on savings, making it a major factor in how interest rates are set across the board—including mortgage rates.

The Reserve Bank reviews the OCR around seven times a year, making changes (or leaving it unchanged) based on how the economy is performing.

- When the OCR goes up, borrowing becomes more expensive. Banks usually increase their own interest rates, meaning mortgage repayments become higher. This is often done to cool down inflation or slow economic growth.

- When the OCR goes down, borrowing becomes cheaper. Banks lower their interest rates, which can reduce mortgage repayments and encourage more spending and investment in the economy.

Interest rates explained

An interest rate is simply the cost of borrowing money. When you take out a loan, you'll pay interest on the amount you borrow. It’s expressed as a percentage of the loan and determines how much extra you’ll repay over the life of the loan—on top of the original amount borrowed.

Fixed vs Floating Interest Rates

When taking out a mortgage in New Zealand, you’ll choose between a fixed or floating (variable) interest rate.

- Fixed rates stay the same for a set period, giving you certainty and predictable repayments—ideal for budgeting.

- Floating rates can go up or down with the market, offering more flexibility and the chance to pay off your loan faster, but with less predictability.

Many borrowers choose a split loan, combining both options to balance stability and flexibility.

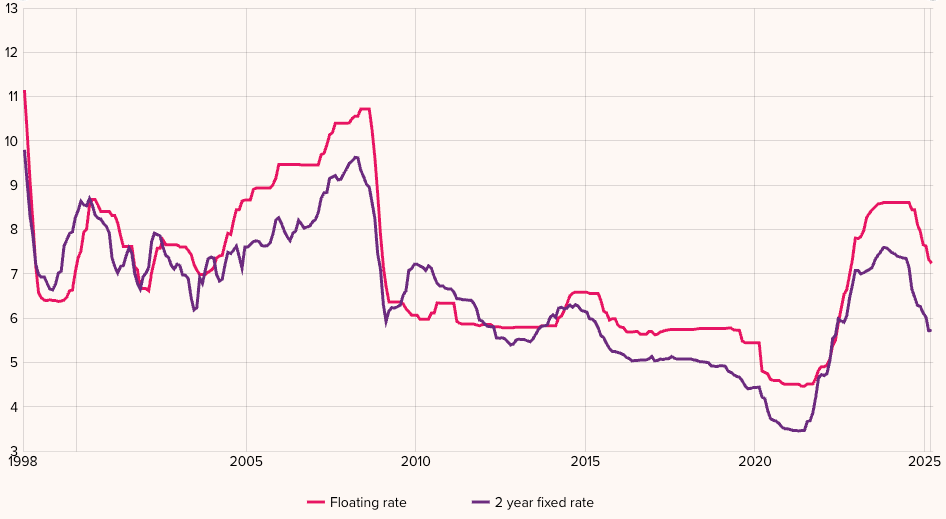

Banks Mortgage Rates – Floating and 2 year fixed (Source: RBNZ)

Types of Home Loans

Choosing the right home loan is crucial to align with your financial goals and lifestyle. Here's a breakdown of the common mortgage types available in New Zealand:

Table Loans

The most common type, with regular repayments covering both principal and interest.

Revolving Credit Loans

A flexible loan linked to your everyday account, allowing you to reduce interest by keeping your balance low.

Offset Loans

Your savings offset the loan balance, reducing the interest charged.

Reducing Balance Loans

Repayments decrease over time as the interest is calculated on the remaining principal.

Interest-Only Loans

You pay only the interest for a set period, with principal repayments starting later.

Learn more about the types of home loans available in New Zealand.

Glossary of Real Estate Terms

Buying, selling, or financing a home can feel overwhelming—especially when the jargon starts flying. But don’t worry, we’ve got you covered. With this handy glossary of real estate terms, you’ll be able to decode the acronyms and understand exactly what your mortgage broker or real estate agent is talking about.

Frequently Asked Questions (FAQs)

Here are some quick-fire answers to your top questions.

What is the minimum deposit needed to buy a house in New Zealand?

Most banks require a 20% deposit, but some first-home buyers may qualify for a low-deposit home loan with as little as 5%—especially through Kāinga Ora's First Home Loan scheme. However, low-deposit loans may come with extra conditions or higher interest rates.

Can I use my KiwiSaver to buy a house?

Yes, if you’ve been contributing to KiwiSaver for at least three years, you may be eligible to withdraw most of your savings to use as part of your deposit. You might also qualify for the First Home Grant, which can add up to $10,000 per person towards your first home.

How long does it take to get mortgage pre-approval in NZ?

Pre-approval usually takes anywhere from 3 to 10 working days, depending on the lender and how quickly you provide your documents. Working with a mortgage broker can often speed up the process.

How does the Official Cash Rate (OCR) affect my mortgage?

The OCR is set by the Reserve Bank of New Zealand and directly impacts interest rates on home loans. When the OCR rises, mortgage interest rates often increase too. When it falls, lenders may reduce rates, making borrowing cheaper.

What’s the difference between fixed and floating interest rates?

A fixed interest rate stays the same for a set period (e.g. 1–3 years), offering predictable repayments. A floating rate can change at any time, depending on the market. Floating loans are more flexible and may allow extra repayments without penalties.

What is a mortgage broker, and should I use one?

A mortgage broker is a licensed professional who helps you find and apply for a suitable home loan. They work with a range of lenders and often don’t charge a fee, as they're paid by the lender. Brokers can simplify the process and help you secure better rates or terms.

Can I get a mortgage with bad credit in New Zealand?

It’s possible, but harder. You may need to go through a non-bank lender, which may charge higher interest rates or require a larger deposit. It’s a good idea to work with a mortgage adviser who has experience helping borrowers with poor credit.

How much can I borrow for a home loan in NZ?

Most lenders will offer up to five times your gross annual income, depending on your financial situation. They’ll also consider your deposit, expenses, and other debts. You can use an online borrowing calculator for an estimate.

How do I choose the best type of mortgage?

The right loan depends on your goals, income, lifestyle, and how long you plan to stay in the home. A mortgage broker or adviser can help you compare loan types (e.g. table loans, revolving credit, offset, or interest-only) and find the one that suits you best.

We hope this article has provided some helpful information. It's based on our experience and is not intended as a complete guide. Of course, it doesn’t consider your individual needs or situation. If you're thinking about buying or selling a property, you should always get specific advice.