Buying guide

The complete beginner's guide to buying a house in New Zealand

Your 7-step guide to buying a house with clarity and confidence

Here’s what we’ll cover:

Keys steps to buying a property in NZ

Step 1: Get Financially Ready

Step 2: Explore mortgage & loan options

Getting pre-approval means certainty over how much you can borrow for your home loan.

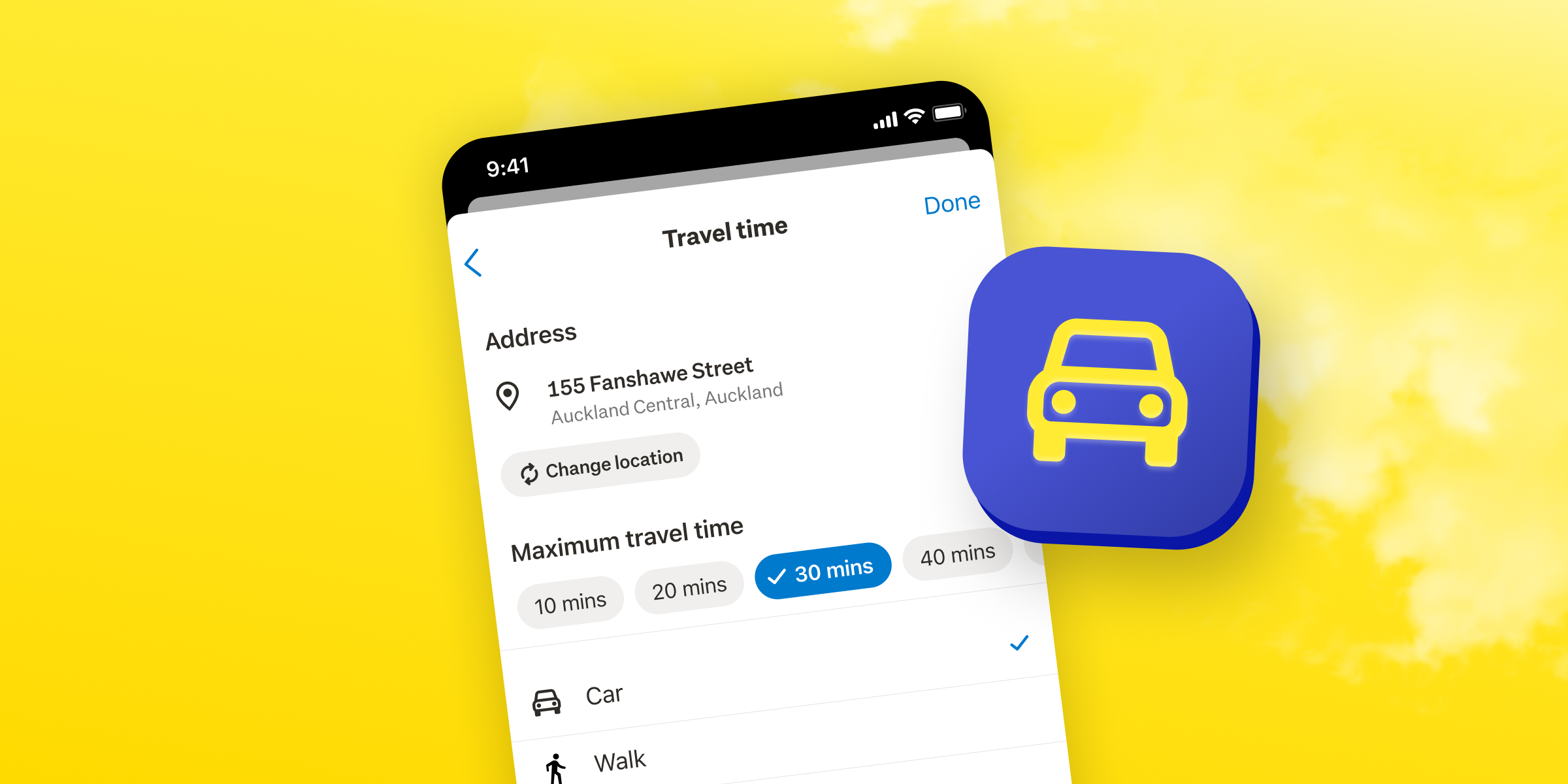

Step 3: Start your property search

Step 4: Do your due diligence

You'll get used to viewing homes, and knowing what to look out for.

Step 5: Making an offer

Step 6: Completing the purchase

Step 7: You’re a homeowner!

Final Words

Author

Search

Other articles you might like