Feature article

NZ property market buyer and seller insights

We surveyed 1500+ Kiwi to understand the current buyer and seller mindsets and trends; and what that may mean for you.

Overall market outlook for Spring 2024

OVERALL MINDSET: 53.1% feel that it's a good time to buy I 23.6% of buyers say they are able to find lots of properties that fit their budgets and needs

There’s a gap in perceived value between buyers and sellers

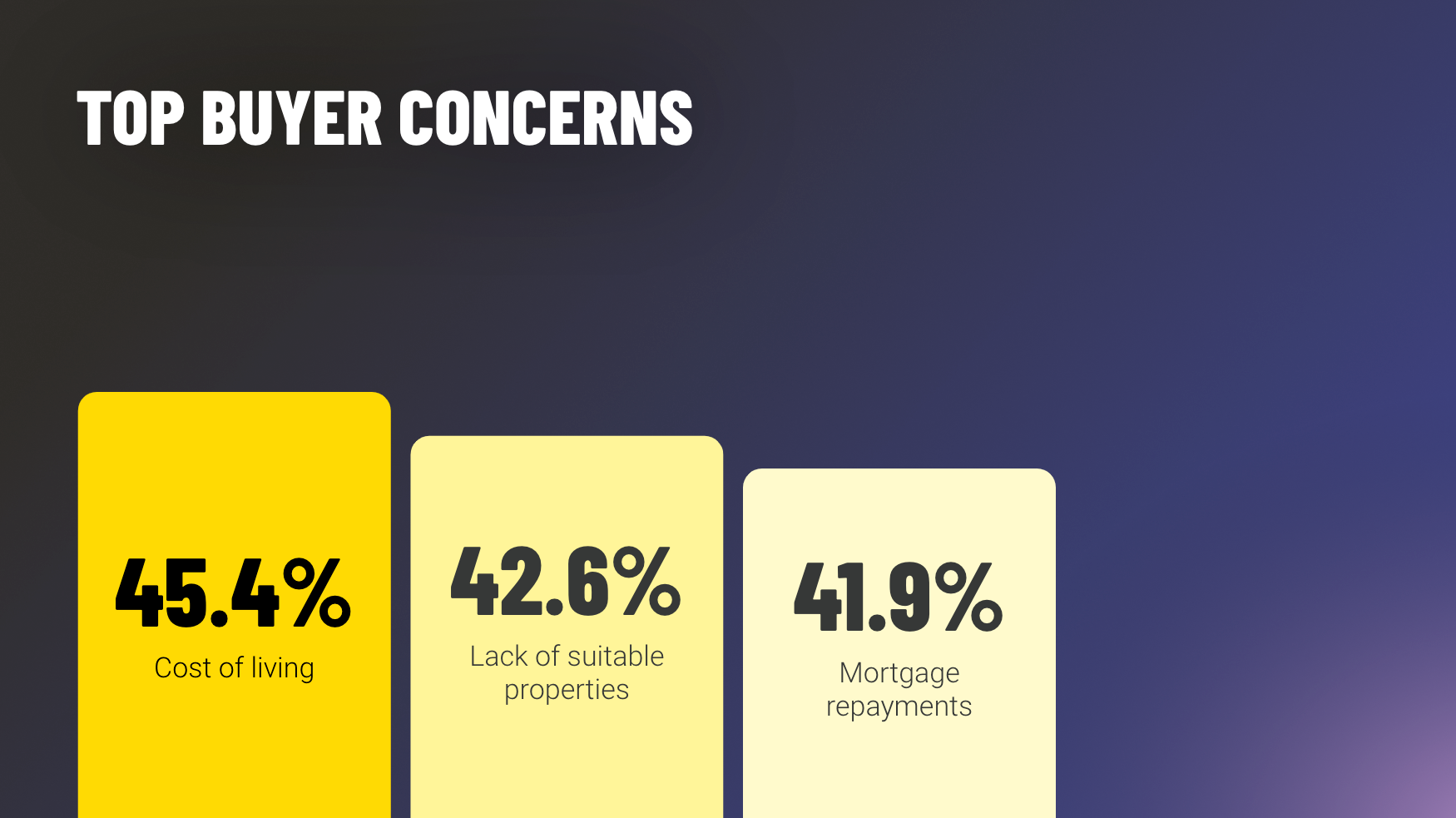

BUYERS’S BIGGEST CONCERNS: 1. Cost of living (45.4%) 2. Lack of suitable properties (42.6%) 3. Mortgage repayments (41.9%)

SELLER’S BIGGEST CONCERNS: 1. Not getting the price they want (74.6%), 2. How long it will take to sell (43.7%), 3. Market conditions (37.5%)

Sellers are willing to wait for their expected price

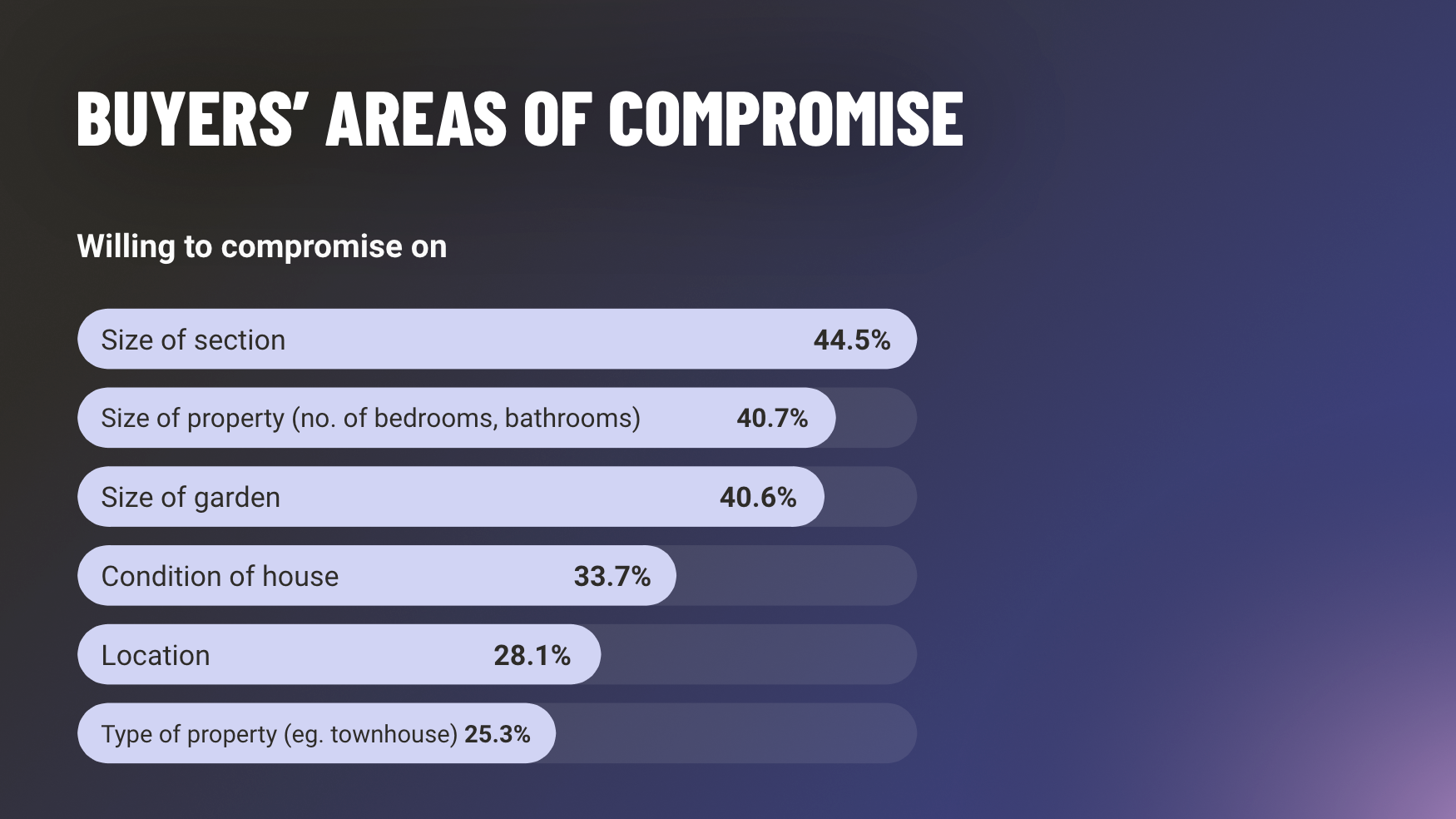

BUYERS ARE WILLING TO COMPROMISE ON: 1. Size of section or land (44.5%), 2. Size of property (40.7%), 3. Size of garden (40.6%)

Buyer vs seller value perceptions

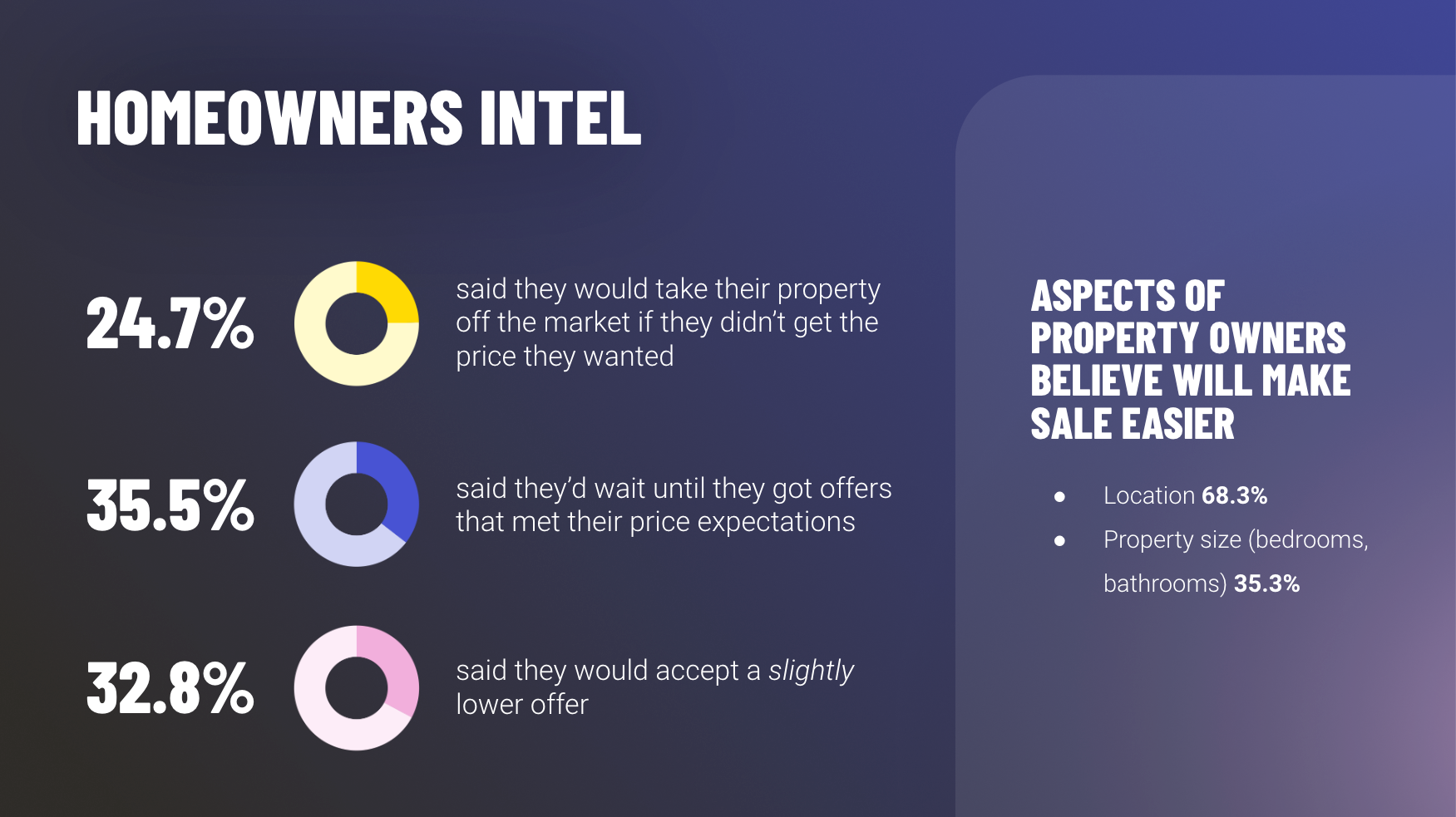

HOMEOWNERS INTEL: If they don't get the price they wanted, 24.7% would take their property off the market, 35.5% would wait to get an offer that met expectations, 32.8% said they would accept a slightly lower offer

The springtime opportunity

Discover More

Search

Other articles you might like