Selling guide

Sale by tender: a NZ homeowner’s guide

Tender is one of the most popular property sales methods in NZ.

.png)

What does it mean to sell a property by tender?

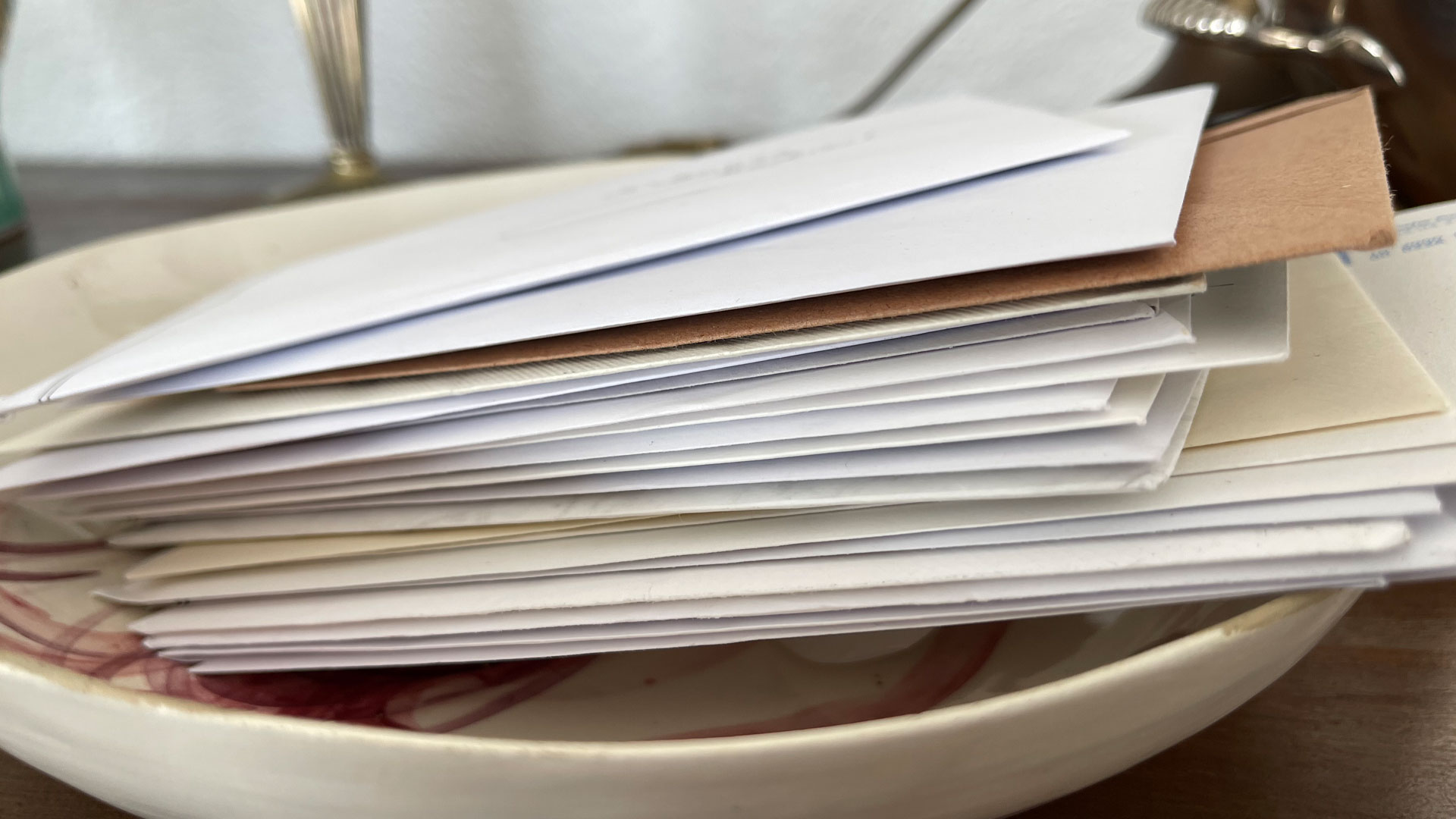

You'll receive tender offers in sealed envelopes.

What’s the difference between a tender sale and a deadline sale

Tender sales can lead to higher sales prices.

Advantages of sale by tender

1. Opportunity for a higher selling price

2. Time to think

3. Buyer flexibility

4. Ideal for unique properties

5. Privacy

Disadvantages of selling your home by tender

1. Risk of lower offers

2. Seller uncertainty

3. Risk of buyers working together

4. Marketing costs

5. Buyer reluctance

Author

Discover More

WATCH: Inside Tim & Isabelle Weston's Merivale Oasis

The Westons' plan in restoring this mid-90s family home was to create an oasis of calm.

From TV villain to villa vendor: Ex-Shortland St star selling family home

The house was built in 1890, and once served as a rest stop for travellers between the Great South Road and Coromandel.

Search

Other articles you might like