Buying guide

When will interest rates drop?

Get ready to pay the bank a little less

At the time of writing, in December 2024, interest rates are on a steady downward trajectory. The question is how far down will rates go, and when will interest rates drop next?

To help homeowners plan for the future we’ve rounded up everything you need to know to make informed decisions, including key OCR dates and interest rate forecasts from the experts.

Where are interest rates right now? (Dec 24)

Right now, the OCR is sitting at 4.25% and retail interest rates are ranging from the mid 7%s to mid 5%s. Here’s a quick summary of interest rates:

6 month fixed rate

Average: low 7%s

Lowest: 6.95% (Co-operative Bank)

1 year fixed rate

Average: 5.79%

Lowest: 5.49% (Heartland Bank)

2 year fixed rate

Average: mid 5%s

Lowest:5.39% (Heartland Bank)

3-5 year fixed rates

Average: Mid to high 5%s

Lowest: 5.49% (Bank of China)

Where’s the OCR headed?

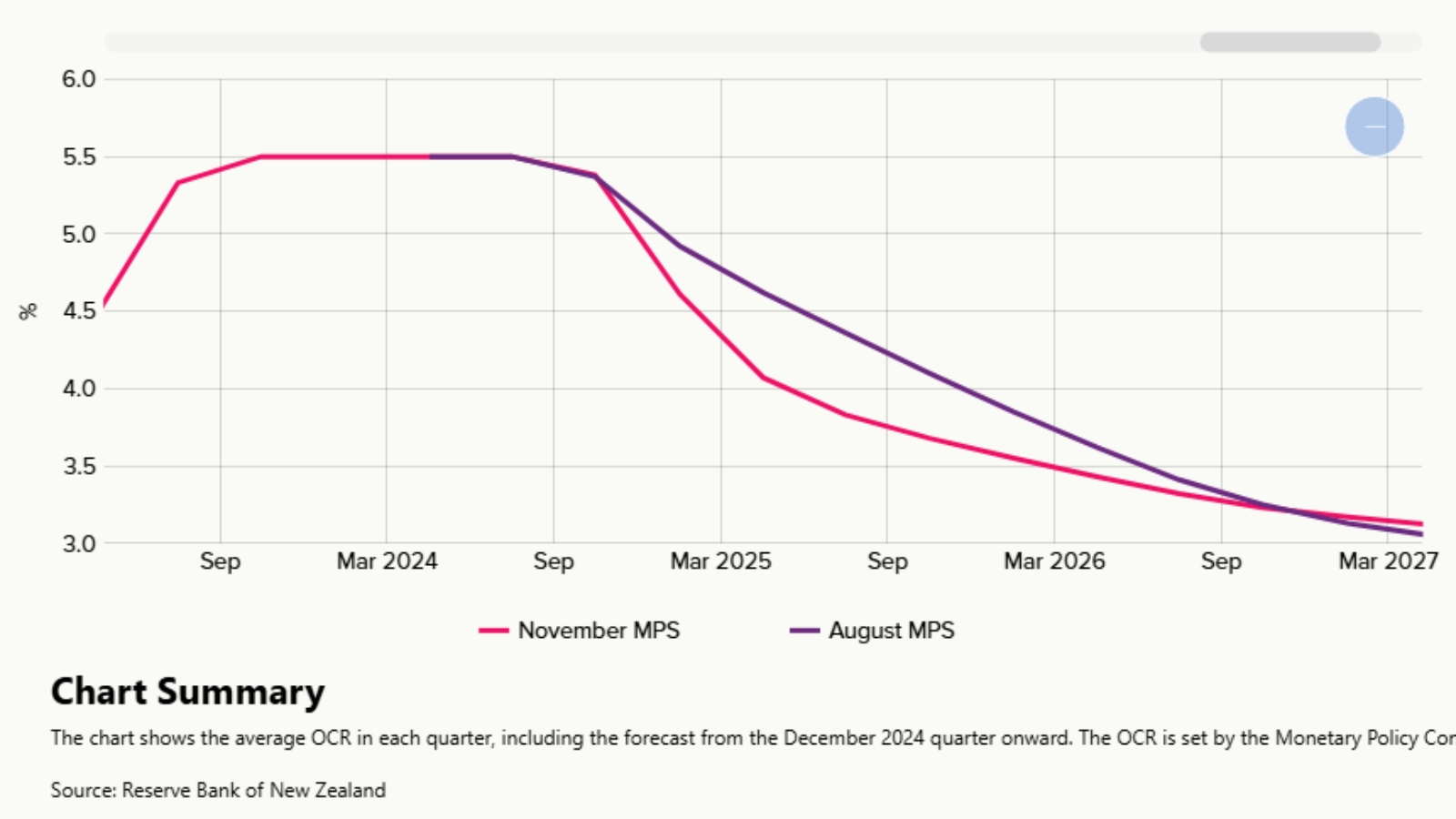

OCR projections from the RBNZ.

If interest rates drop in NZ, it’s often because the OCR has decreased too. The OCR will be reviewed seven times in 2025, and most economists are predicting it’ll head downward throughout the year. Here’s what the market and leading economists are saying:

February 19, 2025 – Monetary Policy Statement

High likelihood of a 50 basis point cut, meaning the OCR could be 3.75% in February 2025. A 25 basis point cut could also happen, meaning the OCR could be 4.0%.

April 9, 2025 – Monetary Policy Review

25 basis point cut possible. OCR could be 3.75% or 3.5% at this stage.

May 28, 2025 – Monetary Policy Statement

25 basis point cut possible. The markets reckon there’s a high likelihood that the OCR will be 3.50% by May 2025. This may be as low as it goes.

After the May cash monetary policy statement, the markets and economists aren’t expecting a lot of movement. Westpac, ANZ and ASB says the OCR won’t go lower than 3.50% but it’ll hit bottom by mid 2025. ASB thinks it’ll take a bit longer to get there – possibly until March 2026.

Kiwibank and ASB, however, think it’ll go to 3.0%, which means we could continue to see cuts throughout 2025 and until early 2026.

What can we expect from interest rates in 2025?

OCR forecasts in summary

The markets and economists are predicting a big rate cut of 50 basis points in February, followed by 25 basis point cuts throughout 2025. If the forecasts are correct, the OCR will reach its lowest point of somewhere between 3.0% and 3.5% between mid 2025 and early 2026.

So, when will interest rates go down?

Longer term interest rates of two to five years have already been adjusted to account for most of the impending OCR cuts, so they may not decrease by much more in 2025, according to bank economists. That said, there should be small decreases in early 2025.

Shorter term interest rates from 6 to 18 months should decrease next year following the OCR cut in February, especially if it goes down by 50 basis points. Economists reckon that these rates will decrease to low 5s, possibly mid-high 4s.

Always get advice

Interest rates are affected by a broad range of factors. The OCR is a big one, but so is the cost of borrowing for the bank, bank margins, global and domestic events. For that reason forecasting interest rates is a difficult task, and predictions are often wrong.

But remember, something could happen tomorrow that completely changes the landscape and means that all these forecasts are way off.

With that in mind, we recommend always seeking professional advice when making decisions about your mortgage. A good mortgage broker can help you structure your mortgage to minimise the effect of changing interest rates to ensure you’re financially secure.

DISCLAIMER: The information contained in this article is general in nature. While facts have been checked, the article does not constitute an advice service. The article is only intended to provide general information about the OCR and interest rates in NZ. Nothing in this article constitutes a recommendation or any specific advice for any person. We cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you. Before making decisions about your mortgage, we highly recommend you seek professional advice.

Author