Feature article

Where will your deposit come from?

Your deposit does NOT have to all come from one place.

“Comparison is the thief of all joy”

Where will your deposit come from?

1. KiwiSaver

2. Savings

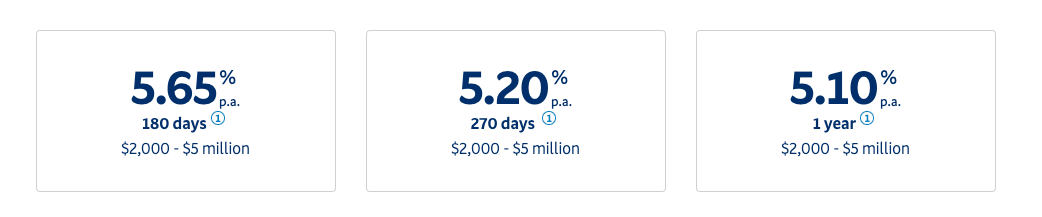

BNZ featured term deposit rates 2024

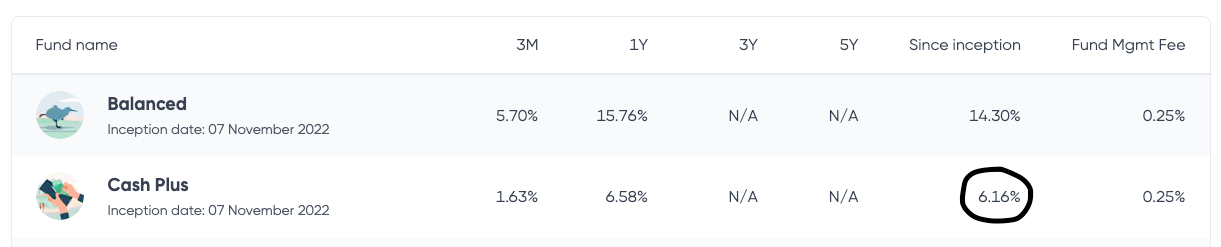

Kernel Fund Performance as of August 2024

3. Bank of mum and dad

4. Other things

Financial Disclaimer

Author

Discover More

Search

Other articles you might like